Apparel sector emissions up 7.5%, driven by ultra-fast fashion

"An unwelcome development, even after several years of flat to slightly declining emissions."

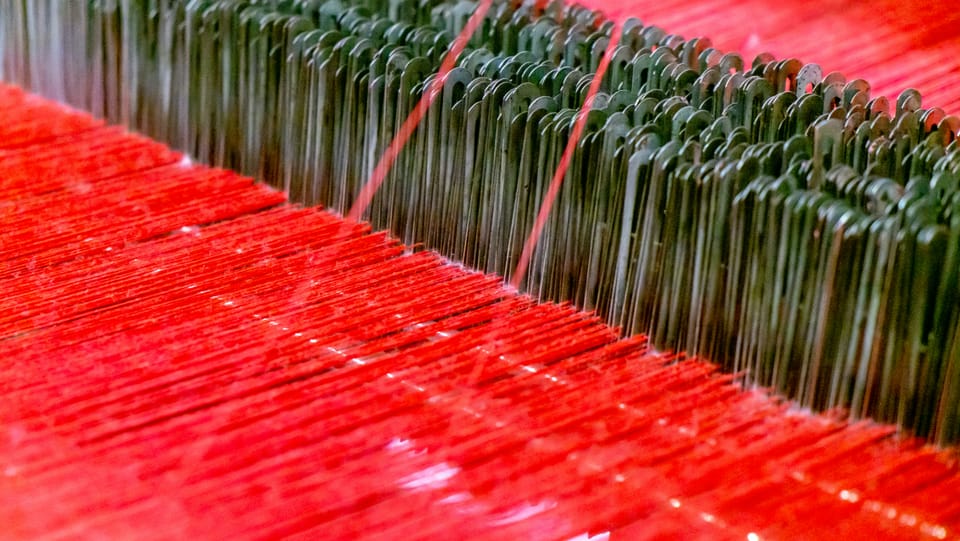

Despite progress around recycled materials and sustainable manufacturing, the apparel sector’s emissions rose 7.5% in 2023, driven by an increase in production and the popularity of ultra-fast fashion brands like SHEIN.

A new report by the Apparel Impact Institute (Aii) estimates that across its entire supply chain, the apparel industry emitted 944.24 million tonnes of CO2 equivalent in 2023 – 1.78% of the world’s overall carbon footprint.