CPP Investments' Chief Sustainability Officer sees "green premium" emerging in real estate

The Chief Sustainability Officer of one of the world’s largest institutional investors, CPP Investments, says demand for greener buildings is set to have a positive “knock-on effect” across other industries as meaningful market signals emerge.

He said companies “favouring low-carbon energy-efficient buildings provide a clear price signal to owners and developers… [we] began seeing the first clear signals of climate-related risk translating into asset prices in the real estate sector.”

Richard Manley is Chief Sustainability Officer at Canada’s CPP Investments, a global investment management organisation that invests the Canada Pension Plan, and which was managing net assets of $570 billion as of March 31, 2023.

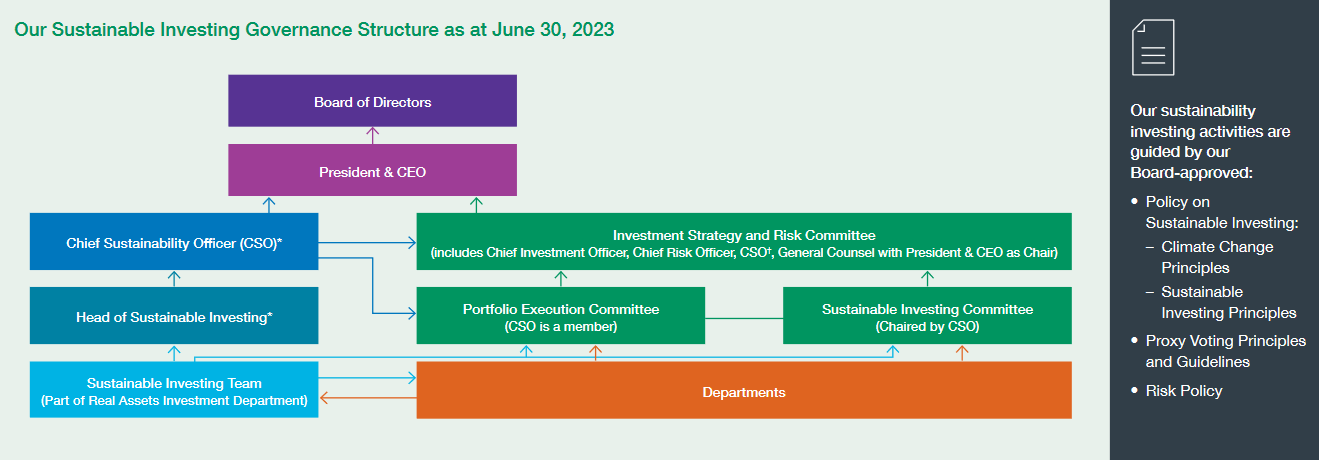

He made the comments as CPP published its 2023 Report on Sustainable Investing, saying it has “enhanced” its Chief Sustainability Officer “accountabilities."

(Manley as CSO reports to CPP Investments' Head of Real Assets. Manley also joins the Investment Strategy and Risk Committee for sustainability discussions.)

“Looking ahead, products across asset classes that constitute climate solutions are likely to merit a green premium, relative to carbon-intensive or grey alternatives.”

He said: “The emergence of a green pricing premium is significant for two reasons. First, it tells companies that there is a volume and price benefit for decarbonizing.

"Second, a premium for green alternatives today is likely to translate into a grey-discount over time – a signal that should act as a warning bell for investors not yet integrating sustainability factors into their investment life cycle.”

He spoke as the commercial real estate (CRE) sector has taken a huge hit from the shift to remote work. Goldman Sachs’ CEO David Solomon said this month that the firm had “either marked or impaired (CRE) down by ~ 50% this year” but as McKinsey has noted, creative approaches to real estate could yet reap rewards.

CPP Investments' CSO is working closely with new COO "to deliver on operational journey to net zero"

Manely wrote as he celebrated a year as CSO, which recently hired a new Chief Operating Officer (COO) Jon Webster with a mandate to include net zero.

As CPP’s President and CEO John Graham emphasised in its annual report, COO Webster’s tasks included working closely with Manley to “deliver on the Fund’s operational journey to net zero… This intensified executive oversight on reducing greenhouse gas emissions complements the Fund’s ongoing efforts to deepen the integration of climate change considerations into the entire investment life cycle.”

(CPP has been a sustainable investment pioneer, being the first pension fund to offer a Green Bond in 2018, for example. In 2022 it committed to both its expansive investment portfolio and operations being net zero by 2050.)

Manley added in his October 19 blog: “Consensus has consolidated around the belief that the financial sector should be empowered to finance the transition to a low-carbon future rather than mobilized to pursue a divestment agenda.

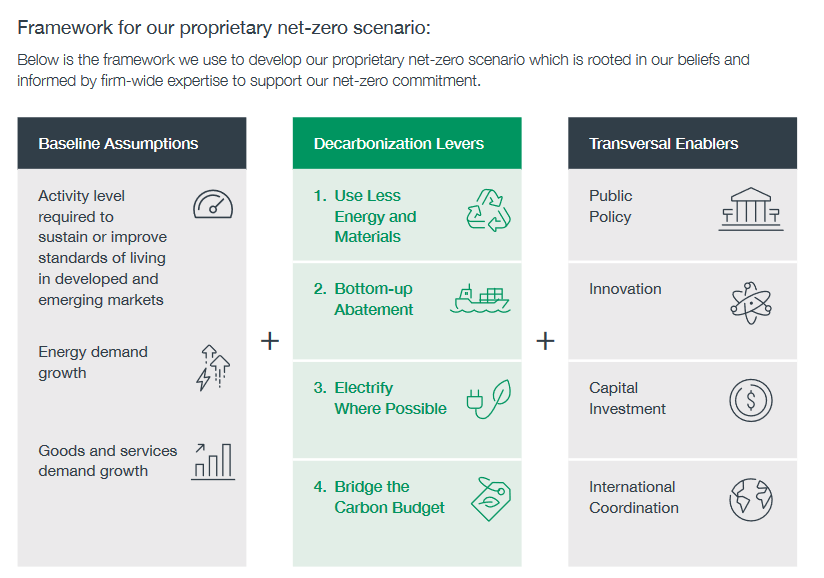

“The optimal green transition is one that removes the most GHG emissions, from operations, while pursuing opportunities that create value for businesses and stakeholders and avoiding sharp dislocations in specific industries and geographies.

"Currently, the transition continues to be influenced by the interplay between regulation, technological progress, future customer and corporate behaviour, abatement costs and carbon prices… Despite the noise and sustained growth in emissions, we remain optimistic about the opportunities ahead for patient capital with advances in policy and market infrastructure.”

Member discussion