Energy transition slows in the US – but rest of the world maintains momentum

Limiting global warming to 1.5°C without a temporary overshoot is no longer possible.

Fossil-first policies in the US may have a marginal impact on the global energy transition, but progress will continue to accelerate in the rest of the world – particularly China.

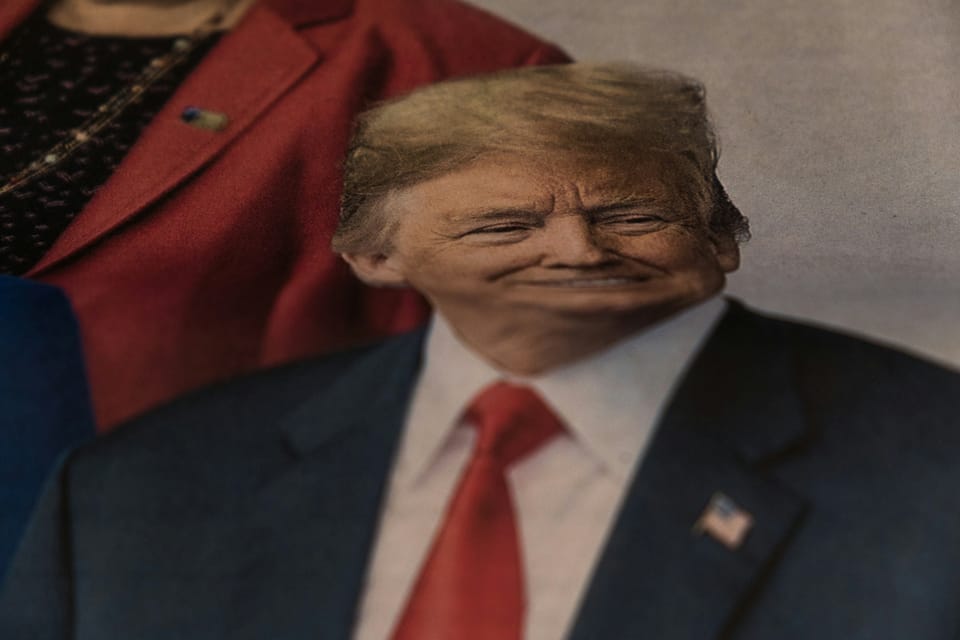

The reversal of policies favouring clean energy in the US under the Trump administration has led consultancy DNV to forecast a five-year delay in emissions reduction in the country, with annual US emissions 500 to 1,000 million tonnes higher than previously thought.