The hidden decarbonisation dilemma: Navigating the copper crunch

This is a guest article written by Melanie Larkins, sustainability executive and Founder and CEO of Holiscentia.

As companies and governments around the world push for electrification and AI integration, copper is a critical piece often excluded from the discussion. This material is at the heart of the energy transition as a key material in wind turbines, solar farms, EV charging stations, and data centres central to the AI transition.

Low investment in infrastructure and access to supply have particularly contributed to a severe copper shortage which threatens global climate goals and innovation. The solution to overcome this bottleneck requires a new playbook for circularity, supply chain resilience, and strategic partnerships.

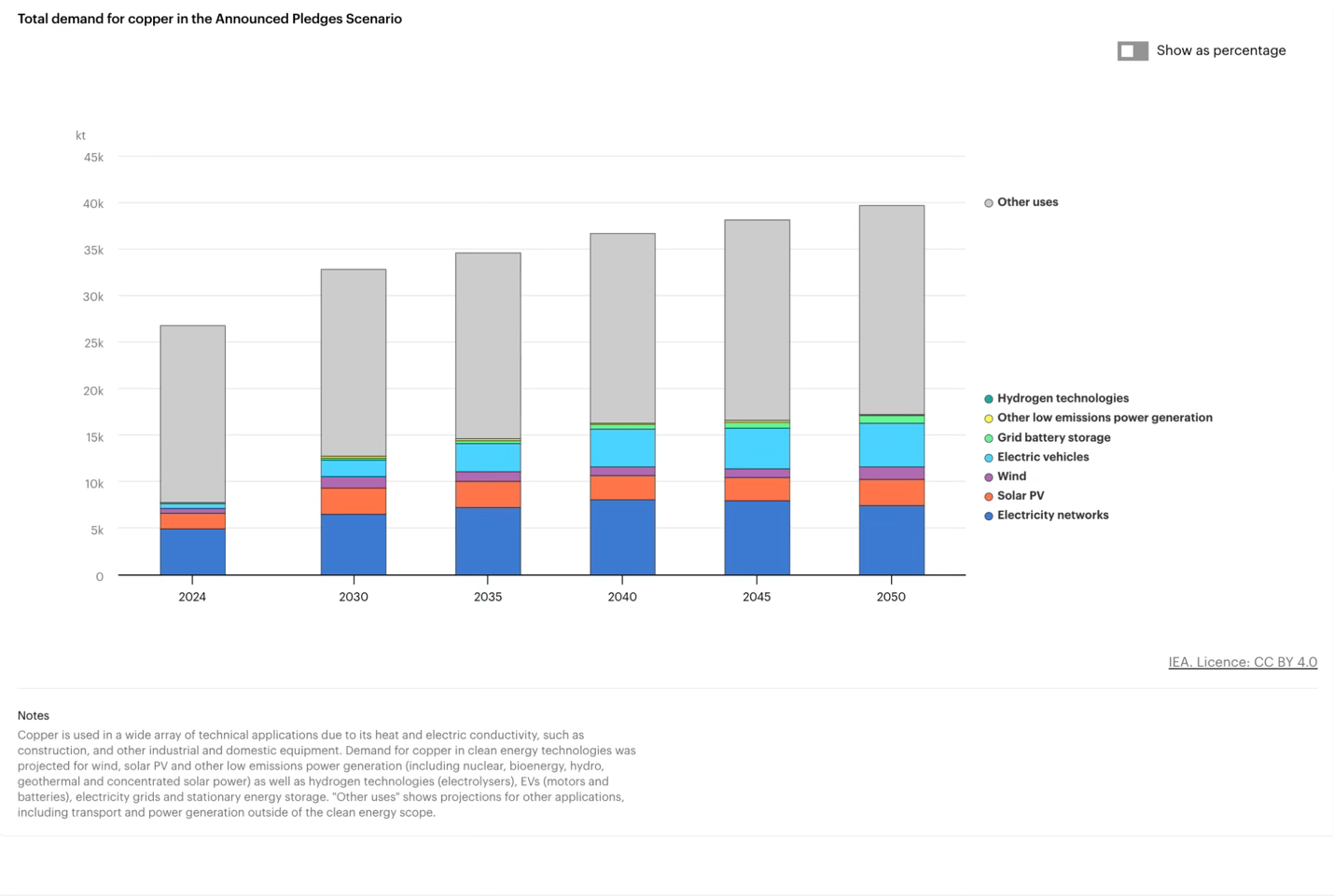

The International Energy Agency (IEA) recognises copper as a “cornerstone for all electricity-related technologies” and estimates that a net zero pathway will require nearly 35 million tonnes of copper annually by 2030. This figure exceeds current mining capacity by approximately 15% and the gap widens to 57% by 2040.

These figures point to the need for a shift in global supply chains, and in how we mine and refine copper.

Beyond the mines: The refinery bottleneck

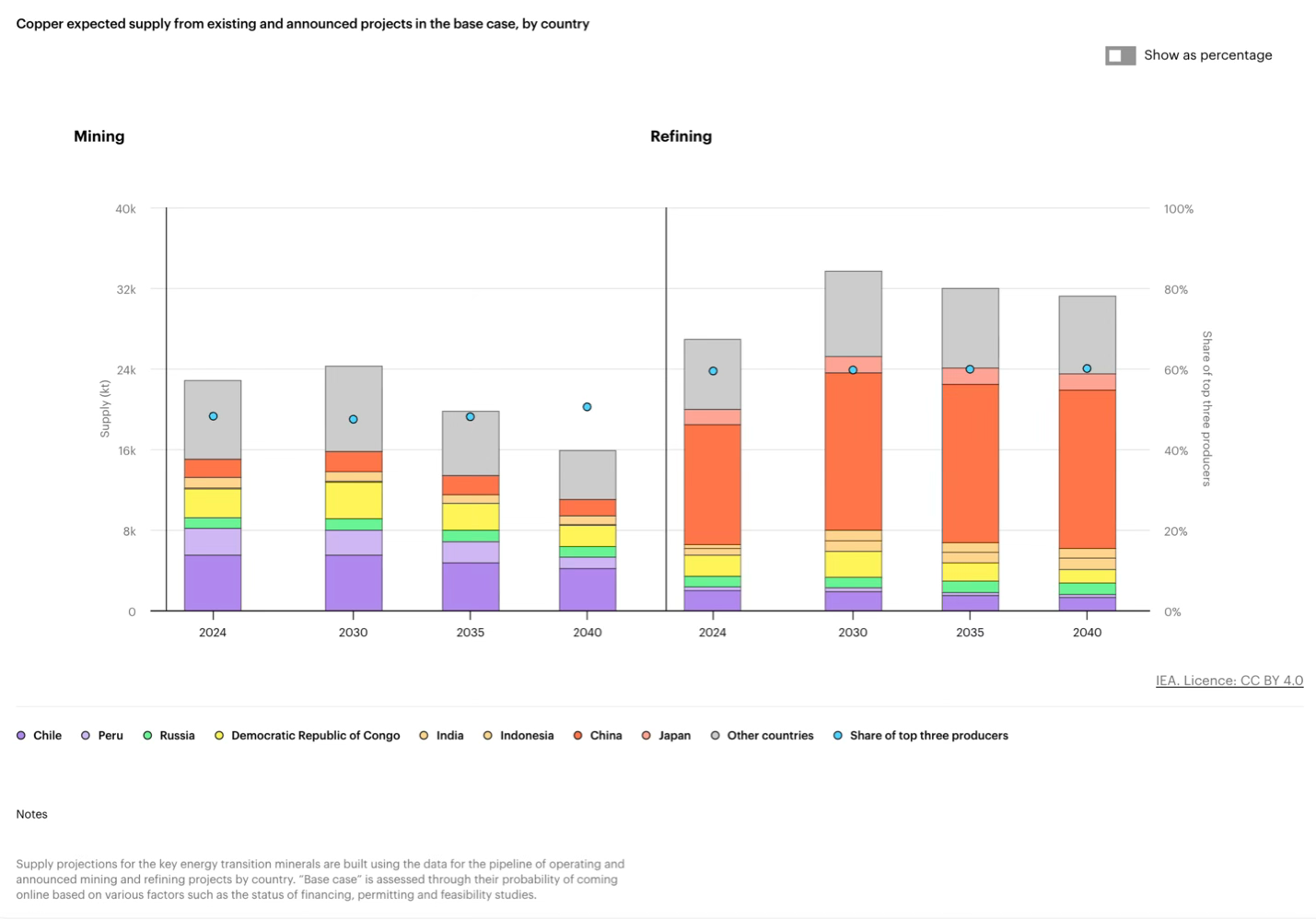

The US, as a hub for both tech and decarbonisation, is acutely vulnerable to copper shortages. The common assumption is that the problem is a lack of raw ore. The reality is more complex.

As data shows, the US produces significant raw copper but lacks the domestic smelting and refining infrastructure to meet its own demand. This creates a critical dependency on imported refined copper. Strengthening domestic capabilities to limit this dependency is a key driver in the recent copper tariffs that went into effect on August 1, 2025.

While potentially benefiting domestic players, the tariffs immediately complicate an already challenged global supply chain for manufacturers and end-users crucial to the clean energy and AI transitions.

The CSO Copper Playbook

Building a resilient strategy is no longer optional. CSOs must partner with their supply chain and procurement leaders, and their peers to develop and implement solutions to meet climate goals. This list offers a view of initiatives that should be central to a resilience strategy as well as some of the challenges:

- Circularity and recycled content - This is the most aligned solution for meeting climate goals. Reduce, reuse, recycle. Recycled copper uses up to 85% less energy than primary production. Partnerships, like the recent collaboration between Schneider Electric and Glencore on circular supply, drive and accelerate circularity.

Challenge - Creating closed-loop systems is complex, and high-purity applications for tech and energy transmission often require virgin material or advanced, costly sorting processes.

- Localised and diverse supply chains - Reducing dependence on long-distance imports mitigates tariff impacts and builds regional resilience.

Challenge - Localisation may reduce supplier diversity, increase operational risks due to potential regional disruptions like droughts, policy changes, or local labor issues.

- Partnerships - Traditional supply chain best practices are paramount. This means moving beyond transactional supplier relationships to strategic partnerships, including long-term contracts and joint investments in capacity.

Challenge - Building relationships and infrastructure takes time. Bringing new refineries or mines online can take a decade or more.

- Material substitution and innovation - In some applications, aluminum or advanced composites can replace copper, and researchers are exploring for new substitution materials such as carbon nanotubes.

Challenge - For the core technologies of electrification and computing, copper’s conductivity is unmatched. Substitution is a limited tool, not a panacea solution.

Next steps

The copper crunch is not a distant forecast. It is a present-day operational and strategic risk that transcends procurement. This worsening global shortage strikes at the heart of the ability of sustainability leaders to execute on climate pledges.

The role of the CSO should expand to include deep material footprint analysis and advocacy for policies that support both supply/refinery development and circular economy investments.

Proactively addressing the copper supply challenge is no longer just about securing a resource; it's about securing the entire energy transition.

Member discussion